Which of the following is a ratio that is best used by commercial banks to measure a company's ability to pay the interest servicing costs on loans?

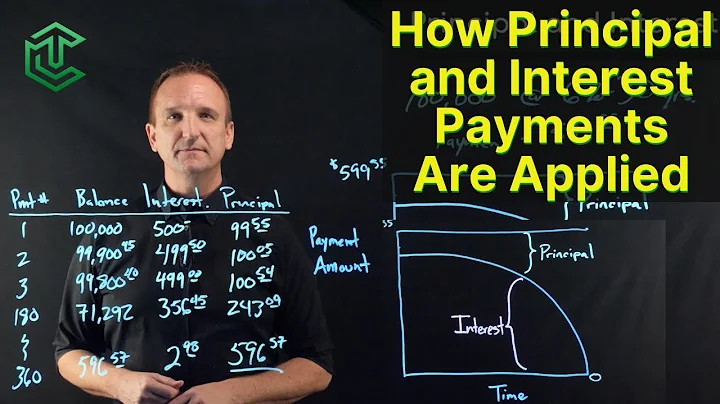

The debt-service coverage ratio (DSCR) is a measure of the cash flow available to pay current debt obligations. DSCR measures a business's cash flow versus its debt obligations. Lenders use DSCR to determine whether a business has enough net operating income to pay back loans.

The ratio that is best used by commercial banks to measure a company is the debt-to-equity ratio.

While an interest coverage ratio of 1.5 may be the minimum acceptable level, two or better is preferred for analysts and investors. For companies with historically more volatile revenues, the interest coverage ratio may not be considered good unless it is well above three.

In general, there are four categories of ratio analysis: profitability, liquidity, solvency, and valuation. Common ratios include the price-to-earnings (P/E) ratio, net profit margin, and debt-to-equity (D/E).

A higher DSC ratio is better than a lower one, with a typical minimum requirement of 1.25x.

- Net Interest Margin = (Interest Income – Interest Expense) / Total Assets.

- Efficiency Ratio = Non-Interest Expense / Revenue.

- Operating Leverage = Growth Rate of Revenue – Growth Rate of Non-Interest Expense.

- Liquidity Coverage Ratio = High-Quality Liquid Asset Amount / Total Net Cash Flow Amount.

Leverage ratios measure the overall debt level of a business, as well as a business's ability to repay new and existing loans.

The main solvency ratios are the debt-to-assets ratio, the interest coverage ratio, the equity ratio, and the debt-to-equity (D/E) ratio. These measures may be compared with liquidity ratios, which consider a firm's ability to meet short-term obligations rather than medium- to long-term ones.

Common ratios used are the net interest margin, the loan-to-assets ratio, and the return-on-assets (ROA) ratio. Net interest margin is used to analyze a bank's net profit on interest-earning assets like loans, while the return-on-assets ratio shows the per-dollar profit a bank earns on its assets.

The common financial ratios every business should track are 1) liquidity ratios 2) leverage ratios 3)efficiency ratio 4) profitability ratios and 5) market value ratios.

What are the 5 types of ratio analysis quizlet?

There are five major types of financial ratios: liquidity, activity, leverage, profitability, and market.

A debt service coverage ratio of 1 means a property is generating enough income to make its loan payments, while DSCR of less than 1 means it is not. Therefore, commercial lenders always want a project to have a DSCR higher than 1 to reduce the likelihood of a default or foreclosure.

The DSCR includes principal loan payments in addition to interest payments in its calculation, whereas the ICR only factors in interest expenses.

Can I live in a home that I buy with a DSCR loan? No, DSCR loans can only be used to purchase income-generating properties. This type of financing is suited for real estate investors rather than those seeking out a primary residence.

Maintaining the specified Cash Reserve ratio helps banks hold the right amount of funds with them and never fall short of it when needed by their depositors for personal needs.

Explanation: Solvency is the measure of a company's assets in excess of the their liabilities. It measures their ability to repay their debt or their obligations. The debt to asset ratio is a useful and great measure of solvency.

Efficiency ratios include the inventory turnover ratio, asset turnover ratio, and receivables turnover ratio. These ratios measure how efficiently a company uses its assets to generate revenues and its ability to manage those assets.

The Debt-to-EBITDA measure is the most common cash flow metric to evaluate debt capacity. The ratio demonstrates a company's ability to pay off its incurred debt and provides investment bankers with information on the amount of time required to clear all debt, ignoring interest, taxes, depreciation, and amortization.

As per the requirements of IRDAI, insurance companies must maintain a solvency ratio of 1.5. Anything higher than this is considered a good solvency ratio. What is liquidity ratio or solvency ratio?

Accordingly, this ratio works best on businesses that maintain low inventory levels, such as service organizations. The current ratio is not a good indicator of the long-term solvency of a business, since it is only used to compare short-term assets and short-term liabilities.

What is an example of a solvency ratio?

Solvency ratio = (15,000 + 3,000) / (32,000 + 60,000) = 19.6%. It is important to note that a company is considered financially strong if its solvency ratio exceeds 20%. So, from the above solvency ratio example, the company is falling just short of being considered financially healthy.

To monitor liquidity, a bank might have a current ratio or quick ratio. The current ratio is simply current assets over current liabilities. The quick ratio is slightly more conservative measuring only highly liquid current assets, such as cash and accounts receivable, over current liabilities.

Advantages of Ratio Analysis are as follows:

It provides significant information to users of accounting information regarding the performance of the business. It helps in comparison of two or more firms. It helps in determining both liquidity and long term solvency of the firm.

Key performance indicators include: Revenue, expenses, and operating profit: Financial KPIs are mainly determined by the revenue banks and credit unions bring in, the costs incurred, and their profit. At its most basic, profit is determined by subtracting expenses from revenue.

The Bottom Line

Common ratios used are the net interest margin, the loan-to-assets ratio, and the return-on-assets (ROA) ratio. Net interest margin is used to analyze a bank's net profit on interest-earning assets like loans, while the return-on-assets ratio shows the per-dollar profit a bank earns on its assets.