Which investment is known as portfolio investment?

A portfolio investment is ownership of a stock, bond, or other financial asset with the expectation that it will earn a return or grow in value over time, or both. It entails passive or hands-off ownership of assets as opposed to direct investment, which would involve an active management role.

A portfolio is a collection of financial investments like stocks, bonds, commodities, cash, and cash equivalents, including closed-end funds and exchange traded funds (ETFs). People generally believe that stocks, bonds, and cash comprise the core of a portfolio.

An investment portfolio is a basket of assets that typically include stocks, bonds, cash, real estate and more. Investors generally aim for a return by diversifying these securities in a way that reflects their risk tolerance and financial goals.

Portfolio investments are investments in the form of a group (portfolio) of assets, including transactions in equity, securities, such as common stock, and debt securities, such as banknotes, bonds, and debentures.

Examples of foreign portfolio investments include stocks, bonds, mutual funds, exchange traded funds, American depositary receipts (ADRs), and global depositary receipts (GDRs). Foreign direct investment (FDI) refers to investments made by an individual or firm in one country in a business located in another country.

A 401(k) portfolio is a collection of investments you assemble by selecting among the choices your plan offers. The best portfolio for you is one that produces the strongest possible long-term growth at the level of risk you're comfortable taking.

Your 401(k), and any other retirement accounts, are financial assets. These are portfolios in which you hold securities and investment products that have either realized or potential value.

Depending on your profession, your portfolio should include a wide variety of writing samples, photographs, images, project summaries or reports. If you don't have professional experience, consider using work from school, club or volunteer projects. Provide any available feedback with your samples if available.

- Bond funds.

- Dividend stocks.

- Value stocks.

- Target-date funds.

- Real estate.

- Small-cap stocks.

- Robo-advisor portfolio.

- Roth IRA.

As per portfolio definition, it is a collection of a wide range of assets that are owned by investors. The said collection of financial assets may also be valuables ranging from gold, stocks, funds, derivatives, property, cash equivalents, bonds, etc.

How many types of investment portfolio are there?

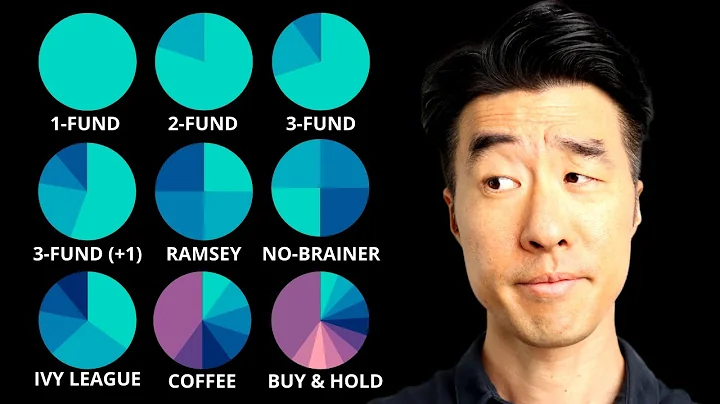

Based on their goals and strategies, they can choose the portfolio type. You can choose from balanced, value, aggressive, hybrid, speculative, and other types of portfolios. Beginners must first learn the significance of different portfolios before making investment decisions.

an investor's set of investment assets.

In finance, asset class is often used to describe a group of investments that are similar and are subject to the same regulations. There are four main asset classes – cash, fixed income, equities, and property – and it's likely your portfolio covers all four areas even if you're not familiar with the term.

Disadvantages of Portfolio Investment

Frequent buying and selling of various assets within the portfolio can lead to transaction fees. These transaction costs cover brokerage fees, commissions, and charges for trading securities. They can lower your investment returns, making your portfolio less profitable.

Foreign direct investment (FDI) is a category of investment that reflects the objective of establishing a lasting interest by a resident enterprise in one economy (direct investor) in an enterprise (direct investment enterprise) that is resident in an economy other than that of the direct investor.

Portfolio income is money received from investments, dividends, interest, and capital gains. Royalties received from investment property also are considered portfolio income sources. It is one of three main categories of income.

- FDIC-Insured High Yield Savings Account. ...

- Fixed Annuities. ...

- US Treasury Securities. ...

- Employer-Sponsored Retirement Plan. ...

- Individual Retirement Accounts (IRAs) ...

- Money Market Accounts. ...

- Low-Cost Index Funds.

Ideally, you'll choose a mix of stocks, bonds, and cash investments that will work together to generate a steady stream of retirement income and future growth—all while helping to preserve your money.

A portfolio is a person's or an institution's entire collection of investments or financial assets, including stocks, bonds, real estate, mutual funds and other securities. A "portfolio" refers to all of your investments — which may not necessarily be housed in one single account.

By age 50, you would be considered on track if you have three to six times your preretirement gross income saved. And by age 60, you should have 5.5 to 11 times your salary saved in order to be considered on track for retirement.

What's the best 401k investments?

- American Funds EuroPacific Growth: HOLD.

- Vanguard Target Retirement 2030 Fund: BUY.

- Dodge & Cox Stock: BUY.

- Vanguard Primecap: BUY.

- Vanguard Wellington: BUY.

- T. Rowe Price Blue Chip Growth: HOLD.

- Fidelity Contrafund: BUY.

- American Funds Growth Fund of America: SELL/HOLD.

The term itself comes from the Italian word for a case designed to carry loose papers (portafoglio), but don't think of a portfolio as a physical container. Rather, it's an abstract way to refer to groups of investment assets.

A portfolio is a compilation of academic and professional materials that exemplifies your beliefs, skills, qualifications, education, training, and experiences.

Your portfolio should contain written and visual overviews of projects and pieces of work that you've managed or been involved with. It should include an insight into skills you have, methods you've used, the impact of your work, along with any relevant outcomes and/or lessons you've learned.

U.S. Treasury Bills, Notes and Bonds

Historically, the U.S. has always paid its debts, which helps to ensure that Treasurys are the lowest-risk investments you can own. There are a wide variety of maturities available. Treasury bills, also referred to T-bills, have maturities of four, eight, 13, 26 and 52 weeks.